Driving sustainable value creation

Our model

UNIVERSAL CUSTOMERFOCUSED BANKING MODEL

Our DNA

A cooperative Group with mutualist values

Three principles of action

A determination to work in the interest of society as a whole and to make progress accessible to everyone

A principled commitment to serving everyone, in all regions, and using all channels to address the wealth management concerns of its customers.

An original model, based on relationship banks, which brings together the products and services of the Group’s specialised business lines; a long-standing presence in all regions to serve their development

Our Raison d’être

"WORKING EVERY DAY IN THE INTEREST OF OUR CUSTOMERS AND SOCIETY"

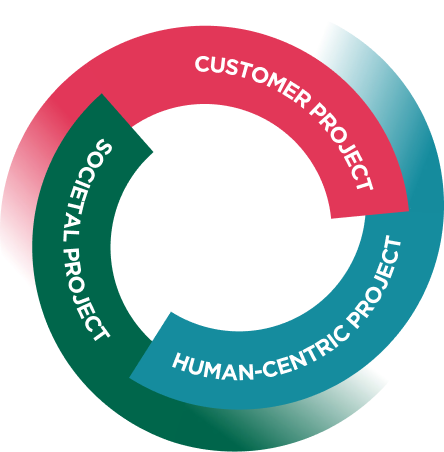

This is embodied by the three dimensions of the Group Project :

Our resources

A DIVERSE GEOGRAPHIC FOOTPRINT

Universal banking facilities

39 Regional Banks, LCL, CA Italia

8,200 retail banking branches

International business lines

46 countries and 54% of Crédit Agricole S.A. employees

Our teams

157,000 Crédit Agricole Group employees

OUR TECHNOLOGICAL EXPERTISE

Centres of technological expertise serving the business lines

€20bn in IT investment between 2022 and 2025

OUR COMMITMENT TO TRANSITIONS

A cross-business-line environmental and social strategy

A Sustainability and Impact business line in all Crédit Agricole S.A. entities

OUR GOVERNANCE

A majority shareholder guaranteeing long-term commitment

OUR DIVERSIFIED PARTNERSHIPS

An organic growth model reinforced by external expertise and distribution partnerships in France and abroad

OUR FINANCIAL CAPITAL

Equity Group share:

Group: €141.9bn

Crédit Agricole S.A.: €74.7bn

Our services

Supporting and advising our customers throughout the various key moments in their lives

Providing financing, savings and insurance solutions

Developing investment solutions

Offering complementary services (payment instruments, real estate, mobility, healthcare, etc.)

Supporting the energy transition of all of our customers and contributing to the decarbonisation of society

Our value creation

FOR OUR CUSTOMERS

#1 funder of the French economy(1) (€817bn in outstanding loans in retail banking, Crédit Agricole Group)

32.7% share of the French home loans market(2)

37.5% share of the French interest-free green loan market(3)

#1 insurer in France(4)

#1 asset manager in Europe(5) (€2,240bn in assets under management)

For our employees

6 million training hours delivered within the Group

23,500 young people welcomed and trained during the year under the “Plan Jeunesse” programme(6)

67,200 employees of Crédit Agricole S.A accessed the LinkedIn Learning platform

84% of Crédit Agricole S.A. employees feel empowered (2024 IMR survey)

40% of women in Crédit Agricole S.A Top 1000

FOR OUR SHAREHOLDERS AND INVESTORS

€38.1bn in Crédit Agricole Group reported revenues

€40.4bn in Crédit Agricole S.A. market capitalisation

€7.1bn in Crédit Agricole S.A. reported income

€8.6bn in Crédit Agricole Group reported income:

• €2.1bn distributed to shareholders and mutual shareholders, and AT1 coupons

• 75% retained and reinvested in regional services

FOR PUBLIC AUTHORITIES AND PARTNERS

€7.5bn of Group procurement

€7.5bn of Group taxes and social security costs

FOR CIVIL SOCIETY AND THE ENVIRONMENT

€31.2bn: in cash invested in green, social and sustainable bonds, Crédit Agricole Group

€22.8bn: handled as bookrunner for green, social and sustainable bonds, Crédit Agricole Corporate and Investment Bank

€26.3bn: in low-carbon energy financing, Crédit Agricole Group(7)

€10.4bn: in assets linked to revitalising territories and reducing inequalities(8), LCL

€16bn: in assets in impact solutions according to the ESG Impact Framework, Amundi

14 GW: of renewable energy production capacity financed, CA Assurances

37% of new financed vehicles are electrified(9), CA Personal Finance & Mobility

Point Passerelle: 12,600 families in financial difficulty helped by Regional Banks

1 ECO, 2024

2 ECO, at end-September 2024

3 Source Crédit Agricole S.A., market share at 30 September 2024

4 L’Argus de l’Assurance, 13 December 2024 (data at end-2023)

5 IPE “Top 500 Asset Managers”, June 2024

6 “Plan Jeunesse” of Crédit Agricole Group: welcoming 50,000 young people between 2022 and 2025 (excluding permanent contracts).

7 Assets linked to low-carbon energy comprising renewable energy produced by the customers of all Crédit Agricole Group entities, including assets linked to

nuclear energy in the case of Crédit Agricole CIB.

8 Offers linked to loans to professionals and SMEs in rural regeneration areas (ZRR).

9 Electric or hybrid vehicles